Jeremie Papin SVP, Chairperson of Management Committee for Americas

Can you tell us about the Nissan NEXT business transformation plan for the US?

The

Nissan

NEXT

business

transformation

plan

for

the

US

evolved

from

the

strategy

that

the

US

leadership

team

had

been

pursuing

since

FY2019.

We

scrutinized

our

entire

enterprise,

with

a

focus

on

changing

our

business,

products

and

culture.

Ultimately

we

developed

a

strategy

based

on

a

virtuous

cycle,

leveraging

the

launch

of

new

models

to

strengthen

our

business

fundamentals

and

rebuild

our

brand

with

a

customer-centric

mindset.

We

are

now

halfway

through

the

plan

and

are

executing

faster

and

better

than

originally

expected.

By

conducting

business

across

all

dimensions

in

a

sustainable

and

profitable

way,

we

will

earn

the

trust

and

confidence

of

our

customers,

dealers

and

suppliers.

This

will

lay

the

foundation

for

our

next

chapter,

in

which

we

will

take

advantage

in

the

growing

adoption

of

electrified

vehicles

to

add

profitable

new

business

streams.

What immediate changes have been made?

The

biggest

fundamental

change

for

our

US

business

is

how

we

set

priorities

when

we

go

to

market.

In

the

past,

we

sought

to

maximize

volume

to

cover

fixed

costs.

However,

lowering

transaction

prices

was

at

the

expense

of

our

brand

value.

Today,

our

focus

is

on

quality

of

sales.

With

the

launch

of

segment-defining

new

products

across

our

sedan,

SUV

and

truck

lines,

we

aim

at

selling

the

full

value

of

each

vehicle

and

gaining

share

with

more

affluent

customers

who

shop

based

on

their

needs.

We

also

want

to

maintain

higher

residual

values.

Ultimately,

we

want

the

customer

experience

of

buying

and

owning

a

Nissan

to

be

one

that

fosters

much

greater

loyalty

and

a

stronger

brand.

And

our

customers

are

happy

with

our

achievements

so

far:

Among

the

major

non-luxury

brands,

we

are

No.

3

for

sales

satisfaction

in

the

industry,

and

No.

2

for

customer

service

satisfaction.

How does the team in the US approach marketing and sales today?

In Marketing and Sales, we are currently pursuing six key strategies:

- Committed investment:Continued and sustained brand investment, focusing on our DNA, to connect the Nissan brand to customers.

- Sustainable volume culture and practice:Moving from a push model to a pull model and eliminating old behaviors like high days supply, high rental ratios and incentive programs which are aimed to increase sales volume.

- Stronger dealer relations:We are going “from worst to first” though transparency, improved communications, higher dealer profitability, lower days supply, and training.

- Nissan North America (NNA) – Nissan Motor Acceptance Corporation (NMAC) loyalty and profit alliance:Building a closer tie with our captive finance organization, as our customers tend to be more loyal to us when they finance with NMAC.

- Customer-first culture across Nissan:We just completed a customer disruption day where we deconstructed and rebuilt all our customer processes. We are working on six workstreams and will start implementing them in 2022.

- Strong EV-ready dealer network:The transformation of our company from ICE to EV is at the forefront of all we do, and our EV network is ready for the new ARIYA. We will have more quick chargers at our dealerships than any other OEM in the US, and training programs to transform our dealers’ mindset on EVs.

We have also completely changed our approach to messaging and advertising. In the past, we allocated about 15% of our marketing expenses to advertising and 85% to incentives. In fiscal 2021, that shifted to 31% on advertising and under 70% on incentives. We have moved to a pull strategy that exemplifies who we are and the thrilling products and innovation that we bring to the marketplace.

What role do products and technology play in Nissan NEXT for the US?

Product

is

at

the

foundation

of

our

recovery.

Our

portfolio

is

now

one

of

the

freshest

in

the

industry.

We

have

significantly

improved

our

ranking

in

third

party

assessments

of

consumer

opinions

on

our

new

vehicles.

Technology

is

also

important.

Here,

a

leading

consumer

intelligence

and

research

firm

ranks

Nissan

in

the

top

tier

in

market

depth,

or

number

of

features,

execution

of

features,

and

innovation

overall.

This

signals

to

our

customers

that

we

are

a

tech-forward,

innovative

company.

Consumer-facing

transaction

prices

are

on

the

rise,

which

means

more

profitability

for

the

company.

We

are

also

attracting

more

credit-worthy

customers

to

the

brand,

as

illustrated

by

the

increase

in

average

household

income

and

new

car

FICOs

(Credit

Score).

This

is

also

visible

in

lower

net

credit

losses.

How have these changes affected relationships with dealers and suppliers?

Dealer

return

on

sales

has

improved

dramatically,

which

has

given

dealers

more

confidence

in

us.

Nearly

all

of

the

new

vehicles

we

build

are

spoken

for

by

a

dealer

at

the

time

of

production,

rather

than

previously

when

we

would

use

incentive

tactics

to

spur

demand.

This

means

faster

turnover,

lower

incentives,

and

more

profitability

for

the

dealer

and

for

us.

Franchise

value

has

also

increased

over

the

last

year

and

a

half.

We

have

changed

the

way

we

work

with

our

suppliers

too,

moving

from

a

short-term

focus

on

commercial

negotiations

toward

long-term,

win-win

solutions.

More

sustainable

business

for

Nissan

also

means

a

more

sustainable

business

for

our

suppliers.

How is Nissan North America preparing for the future?

The

COVID-19

pandemic

accelerated

the

shift

of

customers

who

wanted

more

of

their

shopping

and

purchase

experience

to

happen

online.

We

went

all

in

on

e-commerce

as

a

strategic

advantage

and

became

the

first

to

offer

a

full

end-to-end

delivery

system

where

customers

can

shop,

request

a

test

drive,

apply

for

financing,

complete

their

purchase

and

even

get

service

for

their

vehicle,

all

from

home.

The

Nissan@Home

system

just

won

the

Automotive

News

PACE

Award

winner

for

the

best

new

sales

technology.

Manufacturing

fixed

costs

have

also

improved

over

the

past

few

years,

even

as

quality

results

improved

further.

One

of

the

production

lines

at

our

Smyrna

Plant

in

Tennessee

was

ranked

the

top

plant

in

the

Americas

for

initial

quality,

and

many

of

our

models

were

also

highly

rated

in

their

respective

segments.

We

know

that

this

initial

quality

will

translate

to

strong

long-term

dependability

and

durability,

improving

customer

satisfaction

and

loyalty.

Nissan’s response to electrification will be crucial. Can you share your thoughts on that?

We

are

confident

about

our

prospects

in

the

age

of

electrification.

As

a

company,

we

have

more

than

10

years

of

experience

selling

battery

electric

vehicles,

including

more

than

500,000

Nissan

LEAF

globally.

Those

LEAF

vehicles

have

been

driven

over

5

billion

miles

without

any

major

incidents

or

fires.

Over

80%

of

LEAF

owners

love

their

cars,

and

their

average

household

income

is

significantly

higher

than

the

brand

average.

We

also

have

charging

network

partnerships

with

EVgo

and

others.

We

anticipate

that

40%

of

our

total

sales

in

the

US

will

be

battery

EVs

by

2030,

and

we

intend

to

achieve

this

by

launching

segment-defining

vehicles.

The

all-new

ARIYA

will

pave

the

way

for

the

further

expansion

of

our

EV

offerings

into

the

largest

and

most

exciting

segments

in

the

industry.

This

will

be

supported

by

exciting

technologies:

advanced

driver

assistance

systems

led

by

our

ProPILOT

Assist

2.0,

which

we

intend

to

expand

across

our

lineup;

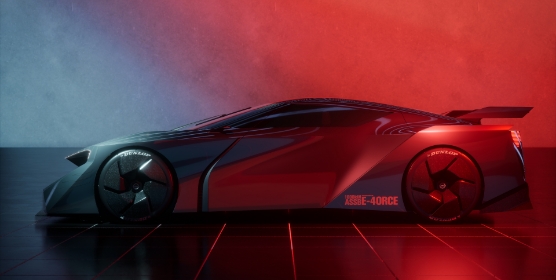

e-4ORCE

that

uses

advanced

all-wheel

drive

to

create

a

dynamic

and

exciting

driving

experience;

building

additional

customer

value

through

connectivity;

and

other

exciting

technologies

that

customers

will

love.

Meanwhile,

our

battery

business

is

about

selling

more

than

the

car.

Along

with

enabling

zero

emissions

and

CO2

credits,

we

will

promote

V2X

for

backup

power

and

grid

stabilization,

and

find

new

opportunities

to

use

our

batteries

in

other

industries.

We

will

also

focus

on

reusing

batteries

as

they

leave

the

vehicle

and

come

into

their

second

life,

to

reduce

CO2

emissions,

lower

disposal

costs

and

increase

the

residual

value

of

our

EVs.

Do you have any final comments you would like to share?

Published in February 2022